What is a Private Limited company?

In accordance with section 2(68) of the Companies Act, 2013 private company means a company having a minimum paid-up share capital as may be prescribed, and which by its articles:-

(a) put restriction to the right to transfer its shares;

(b) except in the case of OPC, which limits the number of its members to 200.

However, where 2 or more persons hold one or more shares in a private limited company jointly, they shall be treated as a single member of that private limited company.

The following persons shall not be included in the number of members of the private limited company:-

(i) persons who are in the employment by the company; and

(ii) persons who, having been formerly in the employment by the company, were members of the company while in that employment and have continued to be members after the employment ceased.

(c) prohibits any invitation to the public to subscribe to any securities of the pvt company.

It is only the number of members is limited to 200. A privately held company may issue debentures to any number of persons, subject to the condition that an invitation to the public to subscribe for debentures is prohibited.

In accordance with the proviso to Section 14 (1) of the Act, if a company is a private company alters its articles in such a manner that they no longer include the restrictions and limitations which are required to be included in the articles of a private company, that Pvt company shall, as from the date of such alteration, cease to be a Pvt.

It is to be noted that the words ‘Private Limited’ must be added at the end of its name by a private limited company.

In accordance with section 3(1), a Pvt company may be formed for any lawful purpose by two or more persons, by subscribing their names to a memorandum and should comply with the requirements of the Companies Act in respect of the Pvt limited registration.

In accordance with section 149(1), a privately held company shall have a minimum number of two directors. The only two members of the private limited company may also be the two directors of the privately held company.

Characteristics of a Private Limited company

| Characteristics | Description |

| Members | To start a company, a minimum number of 2 members is required and a maximum number of 200 members as per the provisions of the Companies Act, 2013. |

| Limited Liability | The liability of each member or shareholder is limited. So, if a company faces loss under any circumstances then its shareholder’s liability will not be unlimited and are not liable to sell their own individual assets for payment and shareholders will not be at risk. The exception to limited liability:- In accordance with section 3A of the Companies Act, 2013, if the number of members of a privately held company is reduced below two, and the business is carried on for more than 6 months, while the number of members is so reduced, every person who is a member of the company during this period and is cognisant of this fact, shall be severally liable for the payment of the whole debts of the company contracted during the time, company runs below 2 members and may be severally sued therefor. |

| Perpetual succession | The company will keep its existence in the eyes of law even in the case of death, insolvency, the bankruptcy of any of its members. So we can say that company has perpetual succession. Perpetual succession means the existence of the company will be forever. |

| Index of members | The maintenance of the index of members is not necessary in case the number of members of the company is less than 50. Which is a privilege for a pvt limited company wherein the number of members is less than 50. |

| Number of directors | A pvt limited company needs to have a minimum of two directors. A private limited company can be registered with help of 2 directors and can start with its operations. |

| Paid up capital | Statutorily, there is no minimum paid-up capital requirement for a private limited company. However, if a paid-up capital requirement arises out of business needs, then it can be as per the business requirement. |

| Prospectus | There is no requirement to issue a prospectus by the private limited company because, in this type of company, the public is not invited to subscribe for the shares the company. |

| Commencement of Business | After the commencement of the Companies (Amendment) Act, 2019 (w.e.f. 02/11/2018), a company incorporated and having a share capital cannot commence any business or exercise any borrowing powers unless – (a) A declaration is filed by a director within a period of 180 days of the date of private company registration with the Registrar. The content of the declaration will be that every subscriber to the memorandum has paid the value of the shares agreed to be taken by him on the date of making such declaration; and (b) The company has filed a verification of its registered office with the Registrar. |

| Name | Using the word “private limited” after their name is mandatory for all private companies. |

Pvt Limited company Registration

SPICe+ Form & AGILE-PRO-S Form

A new web form SPICe+ for incorporation of the Companies replacing the old e-form SPICe is introduced through the Companies (Incorporation) Amendment Rules, 2020 w.e.f 23rd February 2020.

SPICe+ is an integrated Web form. It offers 11 services by 3 Central Government Ministries & Departments (namely the Ministry of Corporate Affairs, the Ministry of Labour & Department of Revenue in the Ministry of Finance) and three State Governments (namely Maharashtra, Karnataka & West Bengal). It saves a lot of procedures, time and cost for registering a company in India. Spice+ is an initiative of the Government of India towards the Ease of Doing Business (EODB).

In accordance with Rule 38 of the Companies (Incorporation) Rules, 2014, the application for private company registration shall be made in SPICe+ (Simplified Proforma for Incorporating company Electronically Plus: INC-32) accompanied by Form No. INC-33 [e-Memorandum of Association (e-MOA)] and Form no. INC-34 [e-Articles of association (e-AOA)].

An application for private company registration under rule 38A of the Companies (Incorporation) Rules, 2014 shall be accompanied by form AGILE-PRO-S (INC-35) containing an application for registration of the following numbers, namely:-

(i) GSTIN (w.e.f. 31st March 2019)

(ii) EPFO (w.e.f. 8th April 2019)

(iii) ESIC (w.e.f. 15th April 2019)

(iv) Profession Tax Registration with effect from the 23rd February 2020

(v) Opening of Bank Account with effect from 23rd February 2020.

(vi) Shops and Establishment Registration.

If the Pvt ltd registration of a company involved more than 7 subscribers or where any of the subscribers to the MOA/AOA is signing at a place outside India, MOA/AOA shall be filed with SPICe+ (INC-32) in the respective formats as specified in Table A to J in Schedule I without filing form INC-33 and INC-34.

Following are the services offered through SPICe+ forms are:-

- Name Reservation,

- Incorporation,

- DIN allotment,

- PAN issue (mandatory),

- TAN issue (mandatory),

- EPFO registration (mandatory),

- ESIC registration (mandatory),

- Profession Tax registration (mandatory) for (Maharashtra, Karnataka & West Bengal),

- Mandatory opening of a Bank Account for the company,

- Allotment of GSTIN (if so applied for),

- Shops and Establishment Registration.

After deployment of the SPICe+ web form, RUN is applicable only for the change of name of existing companies.

Establishment of the Central Scrutiny Centre (CSC)

(Vide Notification No: S.O.1257 (E), Dated March 18, 2021)

- The Central Government has established a Central Scrutiny Centre (CSC) to carry out scrutiny of Straight Through Processes (STP) e-forms under the Companies Act, 2013 w.e.f. from March 23, 2021.

- The CSC shall function under the e-governance Cell of the Ministry of Corporate Affairs (MCA).

- CSC shall carry out scrutiny of the STP forms and forward findings thereon, wherever required, to the concerned jurisdictional Registrar of Companies (ROC) for further necessary action under the Companies Act, 2013.

- Central Scrutiny Centre (CSC) is located at the Indian Institute of Corporate Affairs (IICA), at Plot No. 6, 7, 8 of Sector 5 at IMT Manesar, at District Gurgaon (Haryana), Pin Code- 122050.

Features of SPICE+ Form

The particulars of the maximum of 3 directors shall be allowed to be filled in SPICe+ (Simplified Proforma for Incorporating company Electronically Plus: INC-32), and allotment of Director Identification Number (DIN) of the maximum of 3 proposed directors shall be permitted in case of proposed directors not having approved Director Identification Number.

SPICe+ is an integrated Web Form divided into two parts viz.

| Part | Description |

| Part A | Name reservations for new companies and |

| Part B | Offering a bouquet of services viz. (1) Incorporation (2) DIN allotment (3) PAN issue (mandatory) (4) TAN issue (mandatory) (5) EPFO registration (mandatory) (6) ESIC registration (mandatory) (7) Profession Tax registration (mandatory) (only for companies to be registered in Maharashtra, Karnataka and West Bengal) (9) Opening of a Bank Account for the company (mandatory) (10) GSTIN allotment (if applied) (11) Allotment of Shops and Establishment Registration Numbers (Only for the Delhi Location) |

For the Incorporation of the company, the user may either choose to submit Part-A for reserving a name first and thereafter submit Part B for incorporation & other services or file Part A and B together at one go for incorporating a new company and availing the bouquet of services as above. Incorporation applications (Part B) after name reservation (In Part A) can be submitted as a seamless process in continuation of Part A of SPICe+. In the form, Spice+ Stakeholders will not be required to even enter the SRN of the approved name as the approved Name will be prominently displayed on the Dashboard and a click on the same will take the user for the continuation of the application through a hyperlink that will be available on the SRN/ application number in the new dashboard.

It may be noted that from 23rd February 2020 onwards, RUN service is applicable only for the ‘change of name’ of an existing company and the new web form facilitate On-screen filing and real-time data validation for seamless incorporation of companies. The approved name and related incorporation details as submitted in Part A would be automatically Pre-filled in all linked forms also viz., AGILE-PRO-S, eMoA, eAoA, URC1, INC-9 (as applicable).

All Check forms and Pre-scrutiny validations (except DSC validation) happen on the web form itself. Once the SPICe+ is filled completely with all relevant details, the same would then have to be converted into pdf format, with just a click of the mouse button, for affixing DSCs. All digitally signed applications can then be uploaded along with the linked forms as per the existing process. Changes/modifications to SPICe+ (even after generating pdf and affixing DSCs), can also be done by editing the same web form application which has been saved, generating the updated pdf affixing DSCs and uploading the same.

Registration for EPFO and ESIC shall be mandatory for all new companies incorporated w.e.f. 23rd February 2020 and no EPFO & ESIC registration nos. shall be separately issued by the respective agencies. However, the Registration for Profession Tax shall be mandatory for companies to be registered in Maharashtra, Karnataka and West Bengal.

All new companies incorporated through SPICe+ (w.e.f 23rd February 2020) also be mandatorily required to apply for opening the company’s bank account through the AGILE-PRO-S linked web form.

Declaration by all Subscribers and first Directors in INC-9 is auto-generated in pdf format and would have to be submitted only in Electronic form in all cases, except where:

(i) Total number of subscribers and/or directors is greater than 20 and/or

(ii) Any such subscribers and/or directors have neither DIN nor PAN

Shops and Establishment registration is optional. It is available only for new companies incorporated in the State of Delhi only. But, it is recommended to OPT for registration as no first-time registration will be provided by the Labour department portal.

Pvt Ltd company Registration Process

Step 1: Apply for Name Approval of Pvt ltd registration

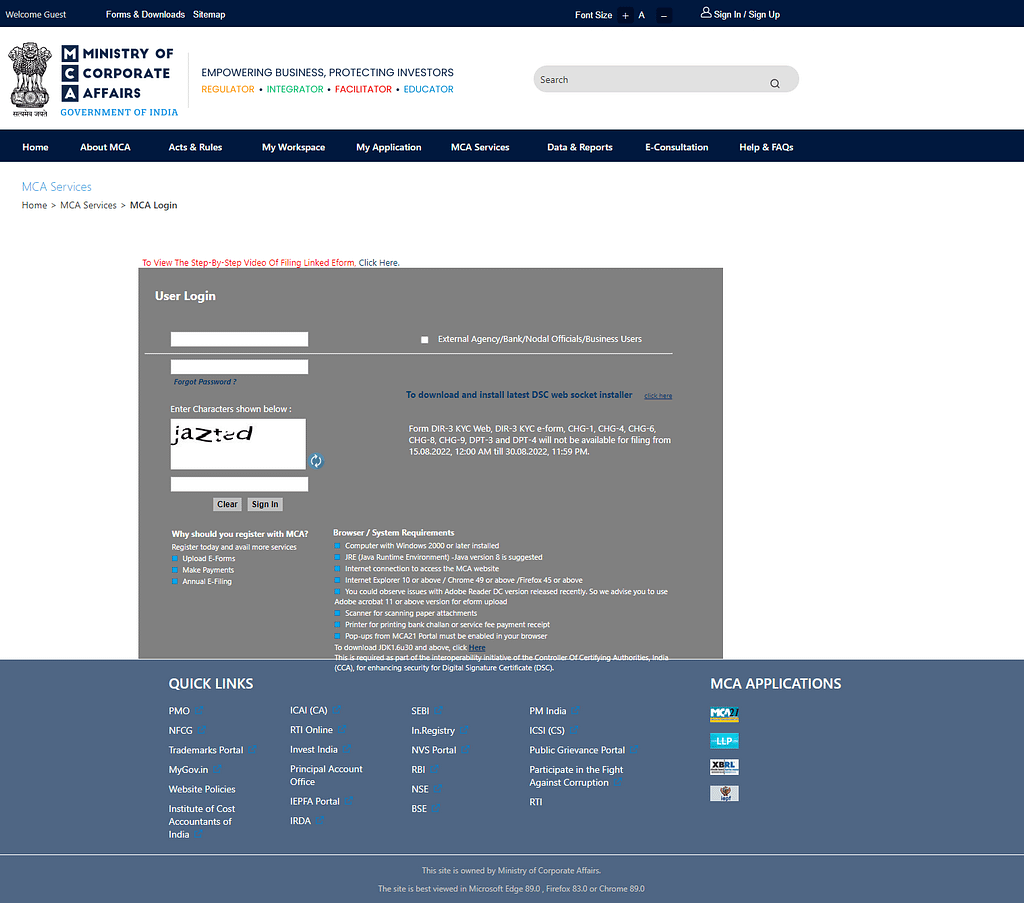

The person who wants to apply for name approval has to login into their account on MCA Website. The person who does not have an existing account has to create an account first and then log in.

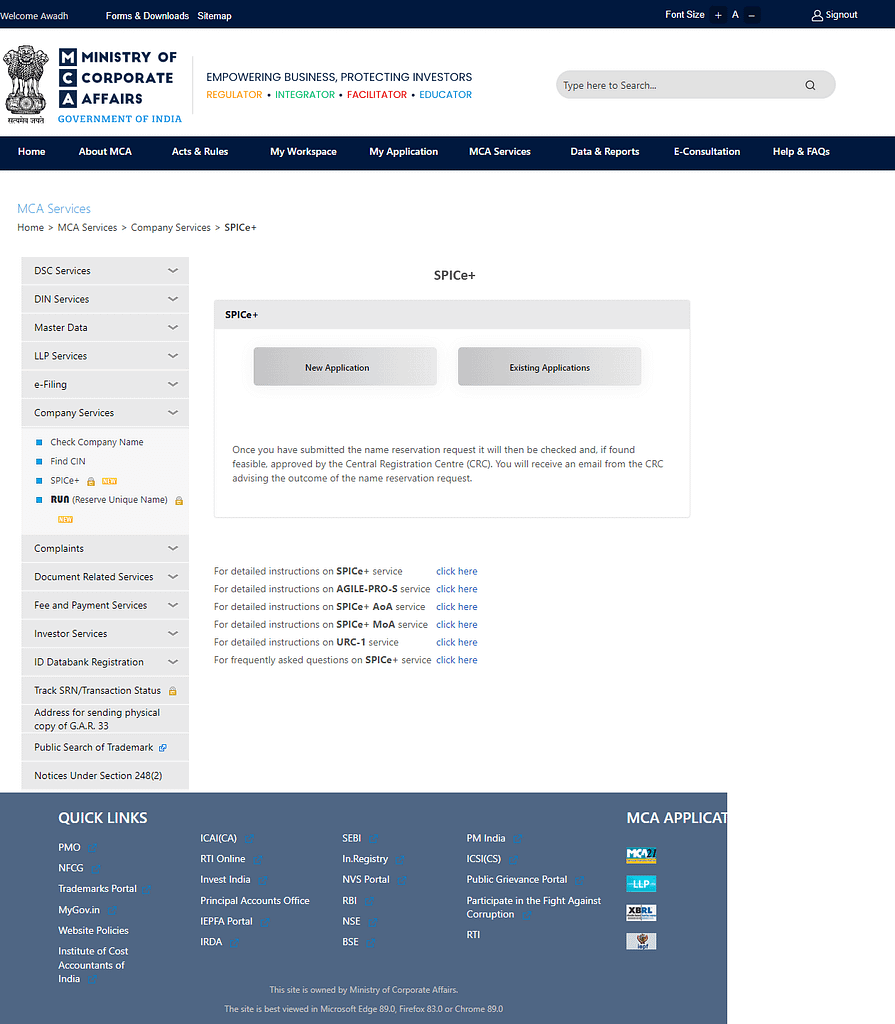

(B) Go to MCA Services>company Services>Spice+ and Click Spice+

After you click the Spice+, two options came before you, New Application & Existing Application. Click the New Application

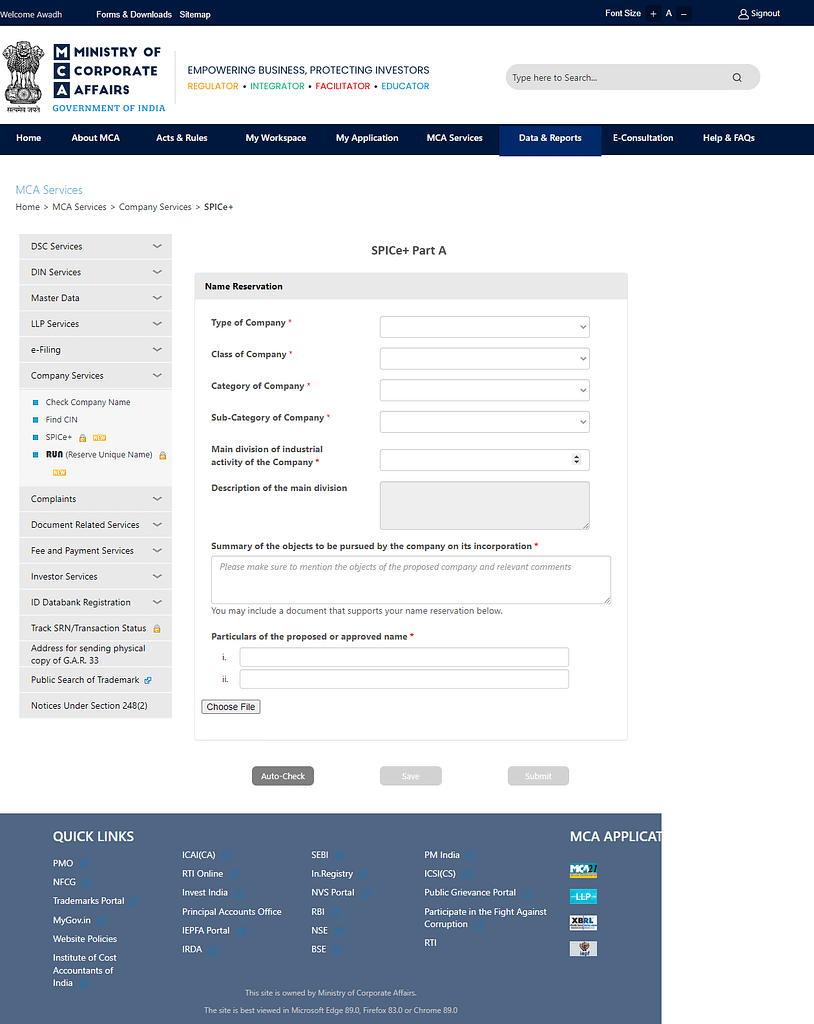

Fill in the online information given in Spice+ Part A. If the applicant wants to attach any file, can be uploaded at Choose File option. Then Submit the Spice+ Part A.

Note: This is not a downloadable form.

Validity of Reserved Name:

After successful submission of the Spice+ Part A, Registrar may approve or reject the name. Resubmission of Spice+ Part A form is allowed within 15 days for rectification of defects in the form. The Reserved name shall be valid for 20 days from the date of approval.

Rule 9A of the Companies (Incorporation) Rules, 2014:- Extension of Reservation of name

(Vide Companies (Incorporation) Third Amendment Rules, 2020 with effect from January 26, 2021)

After payment of fees at www.mca.gov.in, the Registrar shall extend the validity time of a name reservation by using web service SPICe+ (Simplified Proforma for Incorporating company Electronically Plus: INC-32), up to:

(1) 40 days from the date of approval under rule 9 on payment of fees of Rs. 1,000/- made before the expiry of 20 days from the date of approval under rule 9;

(2) 60 days from the date of approval under rule 9 on payment of fees of Rs. 2,000 made before the expiry of 40 days referred to in clause (1) above;

(3) 60 days from the date of approval under rule 9 on payment of fees of Rs. 3,000/- made before the expiry of 20 days from the date of approval under rule 9:

However, the Registrar can cancel the reserved name in accordance with sub-section (5) of section 4 of the Companies Act. 2013.

FAQ to Name Approval for Pvt ltd registration

What is RUN?

RUN service is an easy-to-use web service for reserving a name for a change of name for any existing company. The said service has removed the requirement to use a DSC during name reservations.

What is Part A of web form SPICe+ and can the same be filed separately?

SPICe+ Part A represents the section wherein all details with respect to name reservation for a new company have to be entered. SPICe+ Part A can either be submitted individually for name reservation only or can be submitted together with SPICe+ Part B for both name reservation as well as incorporation and for availing other integrated services.

How do I apply for a name if the proposed name includes the name of a Trade Mark?

In case the proposed name includes a reference to a registered Trade mark name, the user must ensure that he has attached the consent of the owner or applicant for registration of the trade mark along with KYC details (bearing signatures) of the Trademark owner. In case the TM owner is a body corporate, the NOC should be provided in the form of a Board Resolution along with KYC documents.

What are the words on which approval of regulatory authority would be required?

A name shall generally be reserved if it includes the words like ‘Bank’, ‘Insurance’, and ‘Banking’, ‘Venture Capital’ or ‘Mutual Fund’ or if the business activity includes the words like ‘Bank’, Insurance’, and ‘Banking’, ‘Venture Capital’ or ‘mutual funds’ or such similar words with the approval of the regulatory authority.

Provided that the approval of regulatory authority may be obtained at the time of application for incorporation or change of name, as the case may be.

Whether it is necessary to attach Board Resolution/ NOC with the name reservation application?

In case of a change of name of a company, a certified copy of the Board Resolution should be attached.

In case of incorporation of a subsidiary of a Foreign company certified copy of the Board resolution with NOC duly signed by the Authorised Representative should be attached.

Board Resolution is also to be attached while providing NOC for using a resembling name / Trademark.

How many names would be permitted in Part A of SPICe+?

In case an applicant opts for reserving the proposed name first and files Part B of the SPICe+ form later, then a maximum of two names can be applied through SPICe+ Part A, out of which a single name, as made available by Central Registration Centre (CRC), will be approved and reserved for 20 days from the date of approval. In case the entire incorporation application i.e. both SPICe+ Part A and B is being filed together then only one name can be entered in SPICe+ Part A.

In case the subscriber to the memorandum is a foreign national, his signatures and address need to be notarized as per Rule 13 of the Companies (Incorporation) Rules, 2014. In such cases, how can the signature of subscribers be attested?

In such cases, SPICe+ (INC-32) shall be filed along with the manually signed Memorandum of Association (MOA) and articles of Association (AOA). The Signature and address of the subscriber shall be duly notarized/apostilled / consulraised, as applicable.

Whether it is mandatory for every subscriber and/or director to obtain DSC at the time of incorporation?

Yes, it shall be mandatory for each one of them to obtain a DSC, if the number of subscribers and/or directors to eMoA and eAoA is up to 20 and all such subscribers and/or directors have DIN/PAN.

Step II: Documents Preparation for Pvt ltd registration

The following documents are required to be enclosed: For SPICe+:

1) Memorandum of Association;

2) articles of Association;

3) Declaration by the first director(s) and subscriber(s)(Affidavit not required);

4) Proof of office address (Conveyance/Lease deed/Rent Agreement along with rent receipts);

5) Copy of utility bills not older than two months;

6) NOC for use premises for the registered office of the proposed company from owner and person whose name mentioned in the utility bill;

7) Copy of certificate of incorporation of foreign body corporate (if any);

8) A resolution passed by the promoter company (Applicable if the name a body corporate is promoter);

9) The interest of first director(s)in other entities;

10) Consent of Nominee (INC–3)(Applicable for one person company);

11) Proof of identity as well as the residential address of subscribers;

12) Proof of identity as well as residential address of the nominee;

13) Resolution of unregistered companies in case of Chapter XXI (Part I) Companies;

14) Optional attachments(if any).

STEP III: Fill the Information in the Form for Pvt ltd registration

After the availability of the above-mentioned documents/information, the Applicant has to fill in the information in the e-form “Spice+ Part -B.

SPICe+ (INC-32) is a Single Window Form for the Incorporation of a company.

SPICe+ (INC-32) form can be used for the following purposes:

• Application of DIN (up to 3 Directors)

• Application for Availability of Name

• No need to file a separate form for the first Director (DIR-12)

• No need to file a separate form for the address of the registered office (INC-22)

• No need to file a separate form for PAN & TAN

• No need to file separately for GST, or IEC.

Note:- Maximum details of 7 subscribers can be filled in SPICe+. In case of more subscribers, physically signed MOA & AOA shall be attached to the Form.

Step IV: Fill in details of PAN & TAN for a private company registration

It is mandatory to mention the details of PAN & TAN in the Incorporation Form INC-32.

STEP V: Fill in details of GST, and IEC in AGILE-PRO-S for private company registration

If company wants to apply for GST or IEC it has to select YES in the form and fill in the information in the form. If company doesn’t want to apply for GST and IEC then it has to select no.

If Companies wish to perform Aadhar authentication for GSTIN registration, they can select Yes or No in the Agile Pro- S Form.

STEP VI: Preparation of MOA & AOA (Electronic or Physical) for Pvt ltd registration

After the proper filing of the SPICe+ form, the applicant has to file forms INC-33 (e-MOA) and INC-34 (e-AOA) from the MCA site.

Step VII: Submission of INC-32, 33, 34, AGILE-PRO S on MCA

Upload all four documents as Linked forms on the MCA website and make

the payment of the same.

Following is the sequence of uploading linked forms to SPICE +:

i) e-MOA [if applicable]

ii) e-AOA [if applicable]

iii) URC-1[if applicable]

iv) AGILE-PRO-S [mandatory in all cases]

v) INC-9

Companies getting incorporated through SPICe+ with an Authorized Capital of up to INR 15,00,000 would continue to enjoy a ‘Zero Filing Fee’ concession. Such companies will be levied with only stamp duty fees as may be applicable on the state to state basis.

Step VIII: Certificate of Incorporation

The Certificate of Incorporation of the company shall be issued by the Registrar in Form No. INC-11along with CIN, PAN & TAN.

Commencement of Business

In accordance with section 10A read with Rule 23A of the Companies (Incorporation) Rules, 2014, every company incorporated after the commencement of the Companies (Amendment) Act, 2019 and having a share capital shall not commence any business or exercise any borrowing powers unless:

(i) a declaration in form INC-20A is filed by a director within a period of 180 days of the date of incorporation of the company in such form and verified by a company secretary or a chartered accountant or a Cost Accountant. in practice, the Registrar that every subscriber to the memorandum has paid the value of the shares agreed to be taken by him on the date of making of such declaration;

(ii) The company has filed with the Registrar a verification of its registered office in form INC-22 as provided in subsection (2) of section 12 of the Companies Act, 2013;

(iii) If any default is made in complying with the requirements of this section, the company shall be liable to a penalty of Rs. 50,000/- and every officer who is in default shall be liable to a penalty of Rs. 1,000/- for each day during which such default continues but not exceeding a amount of Rs. 1,00,000/-; and

(iv) Where no declaration has been filed with the Registrar under clause (a) of sub-section (1) within a period of 180 days of the date of incorporation of the company and the Registrar has reasonable cause to believe that the company is not carrying on any business or operations, he may, without prejudice to the provisions of sub-section (2), initiate action for the removal of the name of the company from the register of companies under Chapter XVIII.

FAQ to SPICE+

Under which role DSC needs to be associated for First directors not having DIN/subscribers?

First directors not having DIN/Subscribers having PAN shall associate their DSC under’ authorised representative’ by providing their PAN. Once DIN is allocated for the first director’s post-approval of SPICe+, DSC may be updated against DIN by using the ‘Update DSC’ service.

Is registration for Profession Tax through SPICe+ mandatory all over India?

No. Registration for Profession Tax shall be mandatory through SPICe+ only in respect of new companies incorporated in the State of Maharashtra, Karnataka and West Bengal.

Is it mandatory for all new companies incorporated all over India to get Registration for EPFO and ESIC through SPICe+?

Yes. Registration for EPFO and ESIC shall be mandatory for all new companies incorporated w.e.f 23rd February 2020 through the SPICe+ web form and EPFO &ESIC registration numbers shall not be separately issued by the respective agencies.

However, in case the company is being incorporated in an area which falls under the ‘non-implemented area’ for ESIC, ESIC registration shall not be applicable. However, compliances are not required to be carried out in respect of EPFO and ESIC provisions until the company surpasses the threshold limit provided in EPFO and ESIC provisions.

Is it mandatory for all companies incorporated through SPICe+ to open a Bank Account?

All new companies incorporated through SPICe+(w.e.f 23rd February 2020) would also be mandatorily required to apply for opening the company’s bank account through the AGILE-PRO-S linked web form.

Is it mandatory for all companies incorporated through SPICe+ to opt for Shops and Establishment Registration?

No. Shops and Establishment registration is optional. Also, it is available only for new companies incorporated in the State of Delhi only. But, it is recommended to OPT for registration as no first-time registration will be provided by the Labour department portal.

Privileges and Exemptions of Private Limited company

The Companies Act, of 2013, confers certain privileges on private companies which are not subsidiaries of public companies. Private limited companies lose the privileges and exemptions the moment they cease to be private companies.

Consolidated Table of exceptions, modifications and adaptations for Private Companies vide notification dated 5th June 2015 and 13th June 2017 and Corrigendum dated 13th July 2017:-

| S. No. | Notification date | Chapter/ Section number/ Sub-section(s) in the Companies Act, 2013 | Exceptions/ Modifications/Adaptations |

| 1 | 13th June 2017 | Chapter I, clause (40) of section 2. Definition of “Financial Statement | The financial statement, with respect to one person the company, small company, dormant company and a private company (if such a Pvt company is a start-up) may not include the cash flow statement. |

| 2 | 5th June 2015 | Chapter I, sub-clause (viii) of clause (76) of section 2. Definition of “Related Party” | a holding, subsidiary or associate company of such the company, a subsidiary of a holding company to which it is also a subsidiary (i.e. fellow subsidiary) or an investing company or the venturer of the company will not be considered as a related party for the purpose of section 188. |

| 3 | 5th June 2015 | Chapter IV, section 43 and section 47. Kinds of share capital and voting rights | Provisions of Sections 43 & 47 shall not apply where the memorandum or articles of association of the private company so provides. |

| 4 | 5th June 2015 | Chapter IV, sub-clause (i) of clause (a) of sub-section (1) and sub-section (2) of section 62. Further issue of share capital | A Pvt company is not required to comply with the provision with respect to the minimum time period to open the right offer if 90% of the members of a private company have given their consent in writing or in electronic mode. |

| 5 | 5th June 2015 | Chapter IV, clause (b) of sub-section (1) of section Further issue of share capital | A Pvt company can offer shares to employees under a scheme of employees’ stock options by passing ordinary resolutions instead of special resolutions. |

| 6 | 5th June 2015 | Chapter IV, section 67. Restrictions on Purchase by company or Giving of Loans by it for Purchase of its Shares | Provisions of Section 67 are not applicable to private companies – (i) in whose share capital no other body corporate has invested any money; (ii) if the borrowings of such a company from banks or financial institutions or any body corporate is less than twice, its paid-up share capital or Rs. 50 crore, whichever is lower; and (iii) such a company is not in default in repayment of such borrowings subsisting at the time of making transactions under this section. |

| 7 | 5th June 2015 and 13th June, 2017 | Chapter V, clauses (a) to (e) of sub-section (2) of section 73 Prohibition on acceptance of deposits from the public | Provisions of clause (a) to (e) shall not apply to a pvt limited company – (a) which accepts from its member’s monies not exceeding one hundred per cent. of an aggregate of the paid-up share capital, free reserves and securities premium account; (b) or which is a start-up, for five years from the date of its incorporation; or (c) which fulfils all of the following conditions, namely:- (i) which is not an associate or a subsidiary company of any other company; (ii) if the borrowings of such a company from banks or financial institutions or anybody corporate is less than twice its paid up share capital or fifty crore rupees, whichever is lower; and (iii) such a company has not defaulted in the repayment of such borrowings subsisting at the time of accepting deposits under this section: Provided that the company referred to in clauses (a), (b) or (c) shall file the details of monies accepted to the Registrar in such manner as specified. Provided that the company referred to in clauses (a), (b) or (c) shall file the details of monies accepted to the Registrar in such manner as specified. |

| 8 | 13th June 2017 | Chapter VII, the clause of sub-section of section 92 Annual Return | A private limited company which are small company shall prepare an annual return containing the particulars as they stood at the close of the financial year regarding the “aggregate amount of remuneration drawn by directors” instead of “remuneration of directors and Key Managerial Personnel”. |

| 9 | 13th June 2017 | Chapter VII, proviso to sub-section (1) of section 92 Annual Return | In relation to One Person company, small company and private company (if a such private company is a start-up), the annual return shall be signed by the company secretary, or where there is no company secretary, by the director of the company. |

| 10 | 5th June 2015 | Chapter VII sections 101 to 107 and section 109. | Shall apply unless otherwise specified in respective sections or the articles of the company provide otherwise. |

| 11 | 5th June 2015 | Chapter VII, clause (g) of sub-section (3) of section Resolutions and agreements to be filed | Board Resolutions passed u/s 179(3) are not required to be filed with the Registrar in Form MGT-14 |

| 12 | 5th June 2015 | Chapter X, Clause (g) of sub-section (3) of section 141. Eligibility, qualifications and disqualifications of auditors. | An auditor or audit firm can audit a one-person company, a dormant company, a small company and a private company having paid-up share capital of up to 100 crores without counting them in the limit of 20 companies. |

| 13 | 13th June 2017 | Chapter X, clause (i) of sub-section (3) of section 143 Powers and duties of auditors and accounting standards | The provision that an auditor’s report shall state as to “whether the company has adequate internal financial controls with reference to financial statements in place and the operating effectiveness of such controls” shall not apply to a Private limited company: (i) which is a one-person company or a small company; or (ii) which has a turnover of less than rupees fifty crores as per the latest audited financial statement and which has aggregate borrowings from banks or financial institutions or any body corporate at any point of time during the financial year less than rupees 25 crores. |

| 14 | 5th June 2015 | Chapter XI, section Right of Persons Other than Retiring Directors to Stand for Directorship | Shall not apply |

| 15 | 5th June 2015 | Chapter XI, section 162. Appointment of Directors to be Voted Individually | Shall not apply. |

| 16 | 13th June 2017 | Chapter XII, subsection (5) of section 173. Meetings of Board | A One Person company, small company, dormant company and a private company (if a such private limited company is a start-up) shall be deemed to have complied with the provisions of this section if at least one meeting of the Board of Directors has been conducted in each half of a calendar year and the gap between the two meetings is not less than ninety days. Provided that nothing contained in this sub-section and in section 174 shall apply to One Person company in which there is only one director on its Board of Directors. |

| 17 | 13th June 2017 | Chapter XII, subsection (3) of section 174. Quorum for Meetings of Board | Shall apply to a private company with the exception that the interested director may also be counted towards quorum in such meeting after disclosure of his interest pursuant to section 184. |

| 18 | 5th June 2015 | Chapter XII, section Restrictions on Powers of Board | Shall not apply. |

| 19 | 5th June 2015 | Chapter XII, subsection (2) of section 184. Disclosure of interest by Director | The interested director may participate in such a Board meeting after disclosure of his interest. |

| 20 | 5th June 2015 | Chapter XII, section 185. Loan to Directors | Shall not apply to a private company – (a) in whose share capital no other body corporate has invested any money; (b) if the borrowings of such a company from banks or financial institutions or any body corporate is less than twice its paid-up share capital or fifty crore rupees, whichever is lower; and (c) such a company has no default in repayment of such borrowings subsisting at the time of making transactions under this section. |

| 21 | 5th June 2015 | Chapter XII, second proviso to subsection (1) of section 188. Related party transactions | A member who is a related party can vote on the resolution in the shareholders’ meeting. |

| 22 | 5th June 2015 | Chapter XIII, sub- sections (4) and (5) section 196. Appointment of managing director, whole-time director or manager | The provision related to the manner of appointment of managing director, whole-time director or manager including the terms and conditions of such appointment, remuneration payable and filing of return of appointment with the Registrar shall not apply. |

Note: The exceptions, modifications and adaptations provided in column (3) of the above Table shall be applicable to a private limited company which has not committed a default in filing its financial statements under section 137 of the said Act or annual return under section 92 of the said Act with the Registrar.

Features of Private Limited company

For Businesses Raising Funding

Fast-growing businesses that will require funding from venture capitalists

(VCs) need to register as private limited companies. This is because only private limited companies can make them shareholders and offer them a seat on the Board of directors. LLPs would require investors to be partners and OPCs cannot accommodate additional shareholders.

Limited Liability

Businesses often need to borrow money. In structures such as General Partnerships, partners are personally liable for all the debt raised. If it cannot be repaid by the business, the partners would have to sell their personal possessions to do so. In a private limited company, only the amount invested in starting the business

would be lost; the directors’ personal property would be safe.

Start-up Cost

The fee for filing web form SPICe+ for incorporation of the company has been reduced to Zero for proposed companies where the authorized capital is up to Rs.15 Lakhs in case of a company having share capital or where the number of members is up to 20 in case of a company not having a share capital.

Requires Greater Compliance

In exchange for the convenience of easily accommodating funding, the private

company set-up needs to meet the compliances under the Companies Act, 2013. These range from a statutory audit, annual filings with the Registrar of Companies (RoC), annual submission of IT returns, as well as quarterly Board meetings, the filing of minutes of these meetings, and more.

Few Tax Advantages

The private company is assumed to have many tax advantages, but this is not actually the case.