Section 4 of Income Tax Act 1961 – Charge of income-tax

Section 4(1) of Income Tax Act 1961

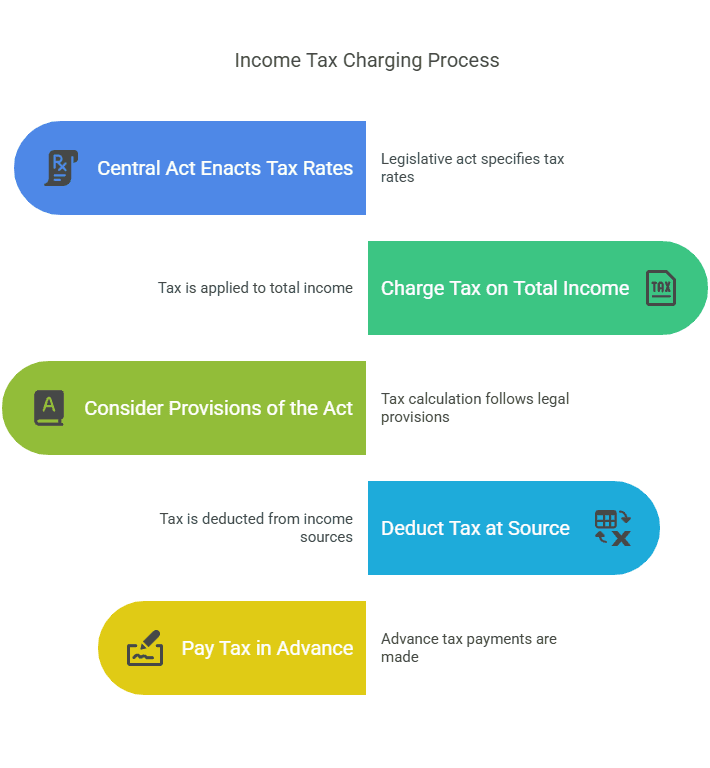

Where any Central Act enacts that income-tax shall be charged for any assessment year at any rate or rates, income-tax at that rate or those rates shall be charged for that year in accordance with, and subject to the provisions (including provisions for the levy of additional income-tax) of, this Act in respect of the total income of the previous year of every person :

Provided that where by virtue of any provision of this Act income-tax is to be charged in respect of the income of a period other than the previous year, income-tax shall be charged accordingly.

Section 4(2) of Income Tax Act 1961

In respect of income chargeable under sub-section (1), income-tax shall be deducted at the source or paid in advance, where it is so deductible or payable under any provision of this Act.

Explanation of Section 4 of Income Tax Act 1961

📘 Section 4 of the Income Tax Act, 1961 – “Charge of Income-Tax”

🔍 What is Section 4?

Section 4 is the charging section of the Income-tax Act.

It gives the government the legal authority to levy income tax on income earned in a previous year.

🧾 Key Provisions of Section 4

- Income-tax is charged on every person (individuals, HUFs, companies, firms, etc.)

- Tax is levied on total income earned during the previous year.

- It is charged at the rates prescribed by the Finance Act of the relevant year.

- Tax is collected in the Assessment Year following the Previous Year.

📅 Example:

Let’s say:

- You earn ₹10,00,000 between 1st April 2024 to 31st March 2025 (Previous Year).

- Tax on this amount will be charged and collected in AY 2025–26, as per the rates in the Finance Act, 2025.

💡 Simple Breakdown:

| Concept | Meaning |

|---|---|

| Section 4 | Gives legal power to collect tax on income |

| Who pays tax? | Every person earning taxable income |

| Tax is based on | Income earned in the Previous Year |

| Tax collected in | The Assessment Year, at Finance Act rates |

🧠 Real-Life Example:

- Ms. Kavya is a salaried employee.

- She earns ₹12,00,000 from April 2024 to March 2025.

- As per Section 4:

- This income is taxable.

- Tax will be charged in AY 2025–26, based on that year’s Finance Act.

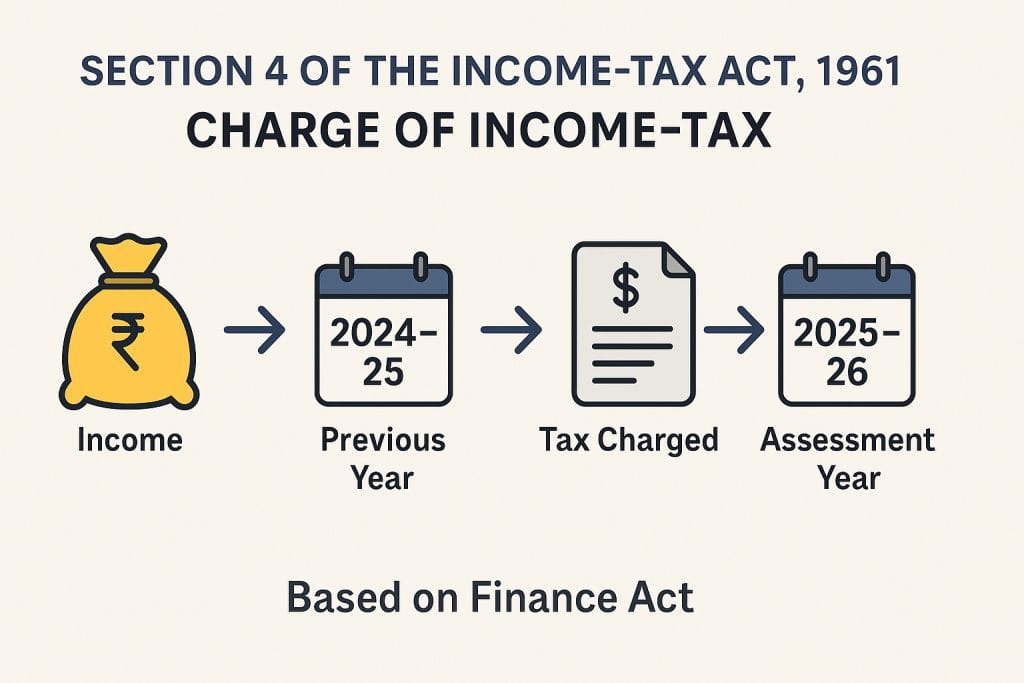

Infographic that visually explains Section 4 with the key flow:

“Income → Previous Year → Tax Charged → Assessment Year → Based on Finance Act”.

Here we go:

🔁 Special Points to Remember

🔹 1. Legal Authority

Section 4 empowers the government to collect income tax.

Without this section, no income tax can legally be levied.

🔹 2. Who is Taxed?

Every “person” is liable to pay tax if their income exceeds the basic exemption limit.

This includes:

- Individuals

- Hindu Undivided Families (HUFs)

- Firms

- Companies

- Associations of Persons (AOPs), etc.

🔹 3. Finance Act is Key

The Finance Act, passed every year with the Union Budget, prescribes the rates of tax applicable for that Assessment Year.

So, even though Section 4 gives the authority to charge tax, the actual rates come from the Finance Act.

📊 Section 3 vs Section 4 – Comparison Chart

| Feature | Section 3 | Section 4 |

|---|---|---|

| Focus | Defines the Previous Year | Grants power to charge income tax |

| Applies To | All taxpayers | All persons earning taxable income |

| Key Concept | Period in which income is earned | Year in which income is charged to tax |

| Time Frame | Always from 1st April to 31st March | Income taxed in Assessment Year (next FY) |

| Taxability | No tax is levied here – just defines the year | Tax is levied as per Finance Act |

| Connection with Finance Act | Not dependent on Finance Act | Tax rates are taken from the Finance Act |

✅ Key Takeaways: Section 4

- Section 4 is the backbone of income-tax collection in India.

- It gives the legal authority to charge tax on the total income of every taxpayer.

- Tax is not charged randomly — it’s charged:

- On income earned in the Previous Year

- In the Assessment Year

- At rates declared in the Finance Act

- Everyone — whether an individual, business, or company — comes under this provision if their income is taxable.

📋 Final Revision Summary – Section 4 of Income Tax Act, 1961

- 📌 Purpose: Charging section – allows income tax to be levied.

- 📅 When charged? In the Assessment Year, after income is earned in the Previous Year.

- 💼 On whom? Every “person” earning income (as defined in Section 2(31)).

- 📖 How much? As per rates prescribed in the Finance Act.

- 🔁 Linked with: Section 3 (Previous Year) and Finance Act (for rates).

FAQs – Section 4 of Income Tax Act, 1961

1. What is the main purpose of Section 4?

Answer:

To legally empower the government to charge income tax on income earned during the previous year.

2. Who is liable to pay income tax under Section 4?

Answer:

Any “person” earning taxable income — individuals, companies, HUFs, firms, trusts, etc.

3. How is income taxed under Section 4?

Answer:

Income is taxed:

In the Assessment Year

Based on income earned in the Previous Year

As per rates specified in the Finance Act

4. Does Section 4 specify the tax rates?

Answer:

No. Section 4 only authorizes the charging of tax. The Finance Act of the relevant year determines actual tax rates.

5. What is the connection between Section 3 and Section 4?

Answer:

Section 3 defines the “Previous Year” (when income is earned)

Section 4 gives the power to charge tax on that income, usually in the Assessment Year

6. Can tax be charged in the same year the income is earned?

Answer:

Generally, no. But in certain exceptional cases (like non-resident shipping under Section 172), tax can be charged in the same year.