Section 35ABA of Income Tax Act 1961-Expenditure on know-how

(1) In respect of any expenditure, being in the nature of capital expenditure, incurred for acquiring any right to use spectrum for telecommunication services either before the commencement of the business or thereafter at any time during any previous year and for which payment has actually been made to obtain a right to use spectrum, there shall, subject to and in accordance with the provisions of this section, be allowed for each of the relevant previous years, a deduction equal to the appropriate fraction of the amount of such expenditure.

(2) The provisions contained in sub-sections (2) to (8) of section 35ABB, shall apply as if for the word “licence”, the word “spectrum” had been substituted.

(3) Where, in a previous year, any deduction has been claimed and granted to the assessee under sub-section (1), and, subsequently, there is failure to comply with any of the provisions of this section, then,—

(a) the deduction shall be deemed to have been wrongly allowed;

(b) the Assessing Officer may, notwithstanding anything contained in this Act, re-compute the total income of the assessee for the said previous year and make the necessary rectification;

(c) the provisions of section 154 shall, so far as may be, apply and the period of four years specified in sub-section (7) of that section being reckoned from the end of the previous year in which the failure to comply with the provisions of this section takes place.

Explanation.—For the purposes of this section,—

(i) “relevant previous years” means,—

(A) in a case where the spectrum fee is actually paid before the commencement of the business to operate telecommunication services, the previous years beginning with the previous year in which such business commenced;

(B) in any other case, the previous years beginning with the previous year in which the spectrum fee is actually paid,

and the subsequent previous year or years during which the spectrum, for which the fee is paid, shall be in force;

(ii) “appropriate fraction” means the fraction, the numerator of which is one and the denominator of which is the total number of the relevant previous years;

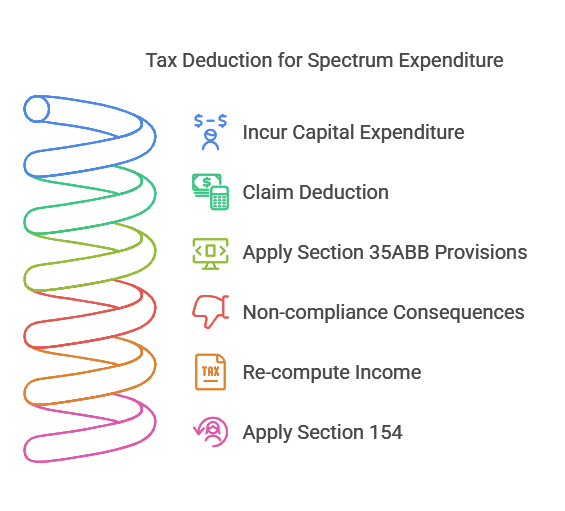

Visuals of Section 35ABA of Income Tax Act 1961

Explanation of Section 35ABA of the Income Tax Act 1961

What is Section 35ABA?

Section 35ABA of the Income Tax Act, 1961 provides a tax deduction for capital expenditure incurred by telecom companies to acquire the right to use spectrum for telecommunication services. Instead of allowing the deduction in one year, the law mandates that the expenditure be deducted in equal installments over the period for which the spectrum rights are acquired.

Who Can Claim the Deduction?

- Only businesses engaged in telecommunication services can claim this deduction.

- The deduction applies to capital expenditure incurred for acquiring spectrum rights (not revenue expenses).

Deduction Process

- The capital expenditure on acquiring the spectrum is spread evenly over the validity period of the spectrum license.

- The deduction is claimed annually in equal portions based on the total period of spectrum rights.

Key Conditions

- Only capital expenditure qualifies for deduction. Revenue expenditure (such as annual license fees) is not covered.

- The deduction is spread over the license period and not allowed in full in one financial year.

- Depreciation (under Section 32) cannot be claimed on the same expenditure if the deduction is taken under Section 35ABA.

Example

- Suppose a telecom company acquires spectrum rights for ₹1,000 crore, valid for 10 years.

- Under Section 35ABA, the company can claim ₹100 crore per year (1,000 ÷ 10).

- If the company sells the spectrum before 10 years, the unclaimed deduction is lost, and the sale proceeds are taxed as per applicable rules.

Effect of Transfer or Sale

- If the telecom operator transfers or surrenders the spectrum before the license period ends, any unclaimed deduction lapses.

- Any sale consideration received from the transfer will be taxed as income under the applicable provisions.

Why Was Section 35ABA Introduced?

- To allow telecom companies to recover spectrum costs in a systematic and fair manner.

- To prevent companies from claiming large deductions in a single year, which could distort tax revenues.

- To align tax treatment with economic usage of spectrum rights over time.

Conclusion

Section 35ABA helps telecom businesses claim tax benefits on spectrum acquisition costs while ensuring a fair and systematic deduction over the spectrum’s useful life. It prevents misuse of tax deductions and ensures the expenditure aligns with the actual period of business use.

FAQs on Section 35ABA of the Income Tax Act, 1961

Q1. What is Section 35ABA of the Income Tax Act, 1961?

A: Section 35ABA deals with the tax treatment of capital expenditure incurred for acquiring the right to use spectrum for telecommunication services. It allows a deduction for such expenses over the period of the right to use the spectrum.

Q2. Who can claim a deduction under Section 35ABA?

A: Any assessee engaged in the business of telecommunication services who incurs capital expenditure for acquiring spectrum rights can claim a deduction under this section.

Q3. What is the nature of the deduction allowed under this section?

A: The deduction is allowed in equal installments over the period for which the spectrum rights are available to the assessee.

Q4. Is the deduction available for the entire capital expenditure in the year of payment?

A: No, the deduction is spread over the number of years for which the spectrum rights have been acquired.

Q5. Can a taxpayer claim depreciation on the spectrum cost in addition to the deduction under Section 35ABA?

A: No, if an assessee opts for deduction under Section 35ABA, depreciation under Section 32 on the same expenditure cannot be claimed.

Q6. What happens if the spectrum rights are transferred before the end of the deduction period?

A: If the spectrum rights are transferred before the end of the deduction period, the unclaimed deduction shall not be allowed, and any consideration received will be subject to tax as per the applicable provisions.

Q7. Does this section apply to both new and renewal of spectrum rights?

A: Yes, Section 35ABA applies to both new acquisitions and renewals of spectrum rights, provided capital expenditure is incurred.

Q8. Is there any restriction on the mode of payment for claiming the deduction?

A: There is no specific restriction on the mode of payment, but the expenditure should be capital in nature and incurred wholly and exclusively for acquiring the spectrum rights.

Q9. Can an individual or a non-telecom company claim a deduction under Section 35ABA?

A: No, only businesses engaged in providing telecommunication services can claim this deduction.

Q10. How is the deduction calculated in case of partial year usage?

A: The deduction is calculated proportionately based on the number of years the spectrum rights are valid, ensuring that the expenditure is evenly distributed over the entire period.