Section 3 of Income Tax Act 1961 – “Previous year” defined

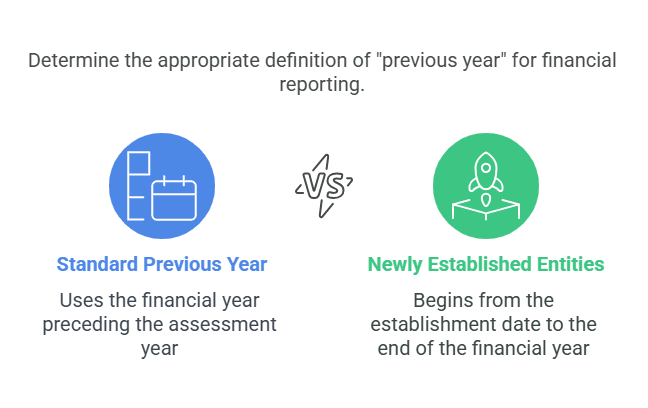

For the purposes of this Act, “previous year” means the financial year immediately preceding the assessment year :

Provided that, in the case of a business or profession newly set up, or a source of income newly coming into existence, in the said financial year, the previous year shall be the period beginning with the date of setting up of the business or profession or, as the case may be, the date on which the source of income newly comes into existence and ending with the said financial year.

Explanation of Section 3 of income tax act 1961

📘 Section 3 of the Income Tax Act, 1961 – “Previous Year” Explained

🔍 What is Section 3?

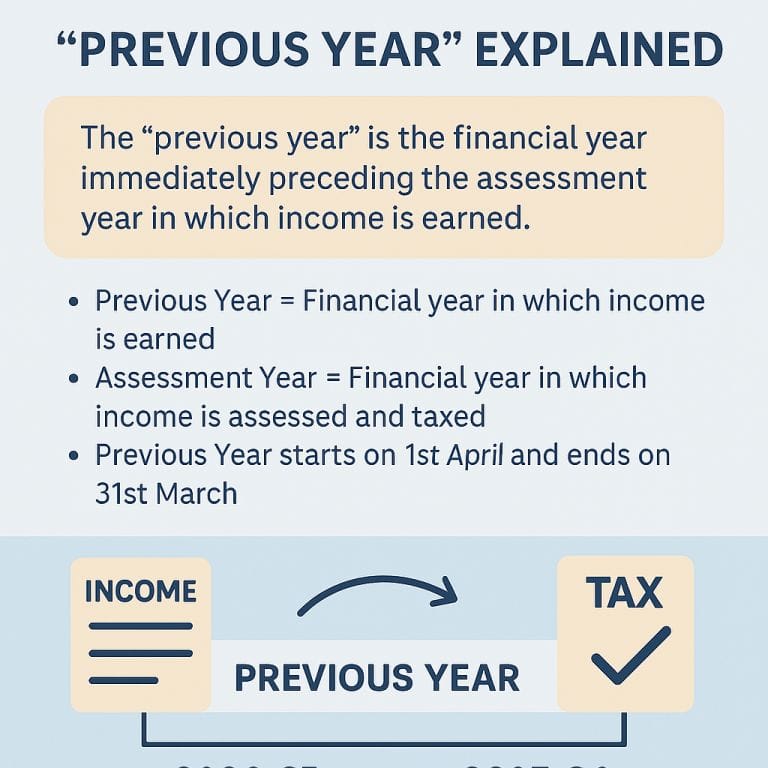

Section 3 defines the “Previous Year” for the purpose of calculating income tax in India.

Previous Year is the financial year immediately before the assessment year in which income is earned.

🧾 Key Points:

- Previous Year = The financial year in which the income is earned.

- Assessment Year = The next financial year in which the income is assessed and taxed.

- The Previous Year starts on 1st April and ends on 31st March of the following year.

📅 Example:

Let’s say:

- You earn income between 1st April 2024 to 31st March 2025.

- This period is your Previous Year.

- The income earned will be assessed and taxed in Assessment Year 2025–26.

So:

- Previous Year: 2024–25

- Assessment Year: 2025–26

📊 Infographic Description

Iinfographic showing:

- Timeline of the Previous Year and Assessment Year

- Income flow and tax assessment stages

🔁 Special Cases Under Section 3

1. New Source of Income

If a person starts a new business or source of income during a financial year, the previous year for that source still starts from the date of starting the business and ends on 31st March of that year.

🧾 Example:

- Mr. A starts a business on 1st August 2024.

- His Previous Year for that business will be from 1st August 2024 to 31st March 2025.

- It will be assessed in Assessment Year 2025–26.

2. Non-Resident Shipping Business

Under certain provisions (like Section 172), income of a non-resident shipping business may be taxed immediately and not wait for the assessment year.

So, in some exceptional cases, tax is charged in the same year as income is earned.

🤔 Why is “Previous Year” Important?

- It sets the period for measuring income.

- Ensures all taxpayers follow a uniform timeline.

- Used to calculate deductions, allowances, and tax liability.

📌 Quick Recap:

| Term | Definition |

|---|---|

| Previous Year | Year in which income is earned (e.g., 2024–25) |

| Assessment Year | Year in which income is taxed (e.g., 2025–26) |

📚 Additional Examples for Better Clarity

🔹 Example 1: Salaried Individual

- Mr. Rahul is a salaried employee.

- He earns a salary during 1st April 2024 to 31st March 2025.

- His income will be assessed in Assessment Year 2025–26.

- So, his Previous Year = 2024–25.

🔹 Example 2: Freelancer or Business Owner

- Ms. Priya starts freelancing on 15th July 2024.

- Her income from freelancing will be taxed in AY 2025–26.

- Her Previous Year for this new income source = 15th July 2024 to 31st March 2025.

⚠️ Common Misconceptions

| Misconception | Reality |

|---|---|

| Previous Year means last calendar year | ❌ No! It always starts from 1st April to 31st March |

| Income is taxed in the same year it is earned | ❌ Incorrect in most cases. Tax is levied in the Assessment Year |

| Previous Year depends on taxpayer’s choice | ❌ It’s fixed under Section 3 for everyone |

📌 Points to Remember (Quick Notes)

- “Previous Year” is defined in Section 3.

- It’s crucial for deciding when income is earned vs. assessed.

- It aligns everyone to a common financial calendar.

- Exceptions exist, but only in specific cases like non-resident shipping or emergency tax recovery.

📝 Summary Card – Section 3 at a Glance

| Concept | Meaning |

|---|---|

| Previous Year | The financial year in which income is earned |

| Assessment Year | The year following the previous year when income is taxed |

| Duration | Always from 1st April to 31st March |

| Relevant Section | Section 3 of the Income-tax Act, 1961 |

| Exceptions | In special cases (non-residents, emergencies), tax may apply in same year |

FAQs – Section 3 of Income Tax Act 1961

What is Section 3 of the Income Tax Act, 1961?

Answer:

Section 3 defines the term “Previous Year” for income tax purposes. It refers to the financial year immediately preceding the assessment year in which income is earned.

What is the duration of the Previous Year?

Answer:

The Previous Year always starts on 1st April and ends on 31st March of the next year, regardless of when the business or profession was started.

What is the difference between Previous Year and Assessment Year?

Answer:

Previous Year: Year in which income is earned (e.g., 2024–25).

Assessment Year: Year in which income is assessed and taxed (e.g., 2025–26).

Can the Previous Year be different for different taxpayers?

Answer:

No. The concept of the Previous Year is uniform for all taxpayers. However, in the case of a new business, the Previous Year starts from the date of commencement and ends on the following 31st March.

Is income taxed in the Previous Year or Assessment Year?

Answer:

Generally, income is taxed in the Assessment Year, which follows the Previous Year. However, in some exceptional cases (like non-resident shipping businesses), income may be taxed in the same year.

What happens if a person starts earning income in the middle of the year?

Answer:

The Previous Year begins from the date the income starts (e.g., business starts on 1st July 2024), and ends on 31st March 2025. It will still be taxed in the next Assessment Year (2025–26).

Are there exceptions where tax is paid in the Previous Year itself?

Answer:

Yes. Certain situations like:

Non-resident shipping companies (under Section 172),

Emergency cases (where income might escape assessment),

…may require tax payment in the same year (Previous Year).

Is it mandatory to follow the 1st April to 31st March cycle?

Yes. As per Indian tax laws, the financial year from 1st April to 31st March is the official tax reporting period, and all taxpayers must follow it.